Key points

- The global hospitality sector has entered the final quarter of 2025 on a note of both confidence and caution.

- While luxury and resort segments continue to perform robustly, the midscale and economy categories — particularly across the United States and parts of Asia — are showing signs of fatigue.

- Focused primarily on economy and midscale franchised hotels, the group reported a 5% year-over-year drop in global RevPAR, with the U.

International Hotel News: Luxury Keeps Hotels Afloat Amid Economic Caution

The global hospitality sector has entered the final quarter of 2025 on a note of both confidence and caution. As the world’s leading hotel chains released their third-quarter earnings, the results painted a telling picture of an industry navigating divergent realities. While luxury and resort segments continue to perform robustly, the midscale and economy categories — particularly across the United States and parts of Asia — are showing signs of fatigue. Investors, meanwhile, are watching carefully as growth forecasts are trimmed and capital returns become a favored tool for supporting shareholder value. According to this International Hotel News report, the tone of recent financial disclosures signals that hotel companies are prioritizing efficiency and returns over expansion for the near term.

Luxury and resort properties continue to buoy hotel giants in Q3 2025 as midscale and economy brands face headwinds amid cautious global forecasts.

Image Credit: Raffles Grand Hotel d’Angkor

Hilton’s Luxury Powerhouses Keep Momentum Alive

Hilton Worldwide led with results that exceeded analyst expectations on earnings per share and total revenue but revealed subtle weaknesses beneath the surface. The company posted adjusted earnings per share of $2.11 and revenue of $3.12 billion for the third quarter of 2025. However, system-wide comparable revenue per available room (RevPAR) slipped by about 1.1% compared to the same period last year, driven primarily by weaker performance in midscale and urban properties. Hilton now projects full-year RevPAR to be flat to up by 1%, narrowing its earlier guidance but simultaneously raising its full-year earnings forecast.

The standout performers for Hilton were its high-end brands — LXR, Conrad, and Waldorf Astoria — all of which reported notable growth in both occupancy and daily rates. These luxury names not only cushioned the softness seen in more affordable categories but also showcased the persistent appetite for premium travel experiences. Regions like the Middle East and Africa continued to shine, supported by strong tourism inflows, while U.S. city properties faced demand normalization after the post-pandemic surge.

IHG Navigates a Patchwork of Global Demand

InterContinental Hotels Group (IHG) presented a similarly mixed picture. The company reported that global RevPAR for the third quarter edged up by just 0.1% year over year, while year-to-date figures showed a modest 1.4% increase. Growth was uneven across regions — Europe, the Middle East, Asia, and Africa led gains with a 2.8% rise, but Greater China saw a 1.8% decline and the Americas slipped nearly 1%. Despite these differences, IHG reassured investors that it remains on track to meet its profit targets for 2025, bolstered by an active pipeline of hotel signings and openings. The results highlight the enduring appeal of IHG’s flagship brands, such as InterContinental and Crowne Plaza, particularly in markets benefiting from tourism rebound and corporate travel recovery.

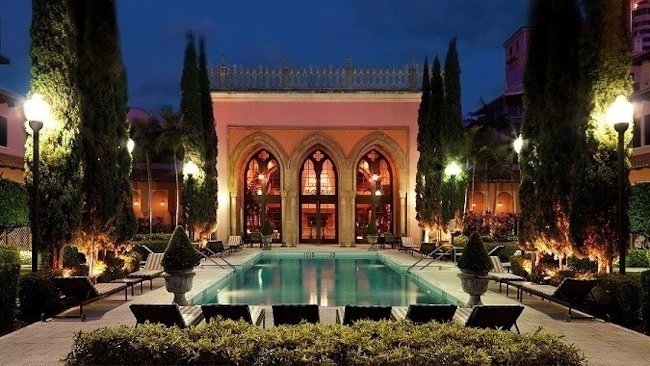

Luxury properties like the Waldorf Astoria Boca Raton Resort are in high demand despite the current economic slump

Image Credit: Waldorf Astoria Boca Raton Resort’s Spa Palazzo

Wyndham Faces Tougher Headwinds in the Economy Tier

For Wyndham Hotels & Resorts, the story was more sobering. Focused primarily on economy and midscale franchised hotels, the group reported a 5% year-over-year drop in global RevPAR, with the U.S. market accounting for much of the decline. Occupancy rates fell by about three percentage points, while average daily rates dropped roughly 2%. Nevertheless, Wyndham maintained solid free cash flow generation and emphasized its focus on cost control and franchising efficiencies to offset revenue weakness. Management’s cautious tone underscores the broader slowdown in budget travel — a segment once buoyed by domestic tourism but now facing competition from alternative accommodations and fluctuating demand patterns.

Accor’s Strong Balance Sheet and Buyback Boost Confidence

Europe’s Accor delivered a slight revenue miss in its third-quarter earnings but surprised markets with a bold show of confidence. The company raised its full-year EBITDA growth forecast and announced a €100 million share buyback for the fourth quarter. This move signaled that Accor is banking on strong cash generation despite short-term revenue headwinds and adverse currency impacts. The group’s regional performance mirrored the global pattern: resilience in Europe and the Middle East contrasted with weaker results in parts of China and Southeast Asia. Accor’s continued asset-light strategy, coupled with aggressive capital returns, has kept investor sentiment largely positive.

Marriott and Hyatt awaited for Market Confirmation

Two of the world’s most closely watched hotel operators — Marriott International and Hyatt Hotels Corporation — are scheduled to release their third-quarter figures in early November 2025. Analysts are anticipating critical insights from these reports, particularly on U.S. RevPAR trends, group bookings, and corporate travel momentum. Marriott’s investor call on November 4 and Hyatt’s on November 6 are expected to provide the final clues about whether the North American hospitality market is entering a sustained slowdown or simply adjusting to post-recovery equilibrium. The commentary from these giants will also help clarify whether management teams plan to emphasize growth, cost efficiency, or capital discipline going into 2026.

Even the luxurious Waldorf Astoria Jerusalem has a high occupancy level despite the war troubled region

Image Credit: Waldorf Astoria Jerusalem

Emerging Themes Shaping the Quarter

A closer look across all the major players reveals several consistent themes. First, luxury and resort properties remain the key drivers of profitability, offsetting weaker results in lower tiers. Hilton and Accor particularly exemplify how high-end demand continues to deliver even as global RevPAR momentum slows. Second, regional divergence is more pronounced than ever: European and Middle Eastern destinations are maintaining robust occupancy, while parts of China and urban U.S. markets are lagging. Third, hotel companies are showing increased caution in their guidance. While Hilton and IHG have narrowed RevPAR expectations, they have simultaneously raised earnings outlooks, emphasizing operational efficiency over expansion. Finally, shareholder value creation through buybacks and capital returns has become a dominant theme — a trend underscored by Accor’s recent announcement.

Analyst Perspectives and Industry Outlook

Analysts describe the quarter as a reflection of normalization rather than contraction. After several years of extraordinary post-pandemic recovery, global travel demand appears to be stabilizing into a more sustainable — if uneven — pattern. The luxury and upper-upscale segments are expected to continue thriving, driven by resilient spending among affluent travelers and ongoing strength in destination resorts. In contrast, the midscale and economy tiers are likely to face pressure from inflation-sensitive consumers and increased competition from short-term rental platforms.

Industry experts also note that the pivot toward capital discipline, cash preservation, and brand diversification signals maturity in an industry that had overexpanded during the recovery years. As 2026 approaches, hotel executives are likely to focus on enhancing digital engagement, optimizing loyalty programs, and exploring asset-light partnerships to mitigate macroeconomic risks. Much will depend on the global economy’s trajectory and whether business travel — still lagging leisure — finally stages a stronger comeback.

Despite the cautious tone, the hospitality sector remains fundamentally strong, anchored by pent-up travel aspirations and a steady flow of investment into luxury, lifestyle, and resort developments. The third quarter of 2025 may mark the moment when growth rebalances, setting the stage for a more selective but still prosperous future for the world’s top hotel groups. Investors and operators alike are bracing for a year where success will depend not just on occupancy and rates, but on strategic agility and brand strength.

For the latest International Hotel News, keep on logging to Thailand Hotel News.