Key points

- Industry analysts note that Thai groups are increasingly seeking strategic footholds in full-service and luxury hotels, moving in a more specialised direction compared to other Asian investors.

- Analysts believe these transactions signal a rising appetite for tourism-linked assets and open new opportunities for developers and operators aiming to reposition or upgrade existing properties in top-tier markets.

- Their sustained commitment suggests that the Thai hospitality sector views Australia not only as a stable market but also as a gateway for building global hotel portfolios with lasting value.

Thailand Hotel News; Thai Capital Accelerates in Australia’s Hospitality Sector

Thailand is rapidly emerging as one of the most focused foreign investors in Australia’s hotel market, with AUD 376 million committed to hospitality assets during FY2025. This rising investment momentum highlights Thailand’s growing confidence in Australia’s tourism-driven cities and its long-term view of premium hotel ownership. Industry analysts note that Thai groups are increasingly seeking strategic footholds in full-service and luxury hotels, moving in a more specialised direction compared to other Asian investors. This Thailand Hotel News report highlights how this deliberate push sets Thailand apart as a targeted hospitality investor rather than a broad-based property acquirer.

Thai hotel groups accelerate acquisitions in Australia

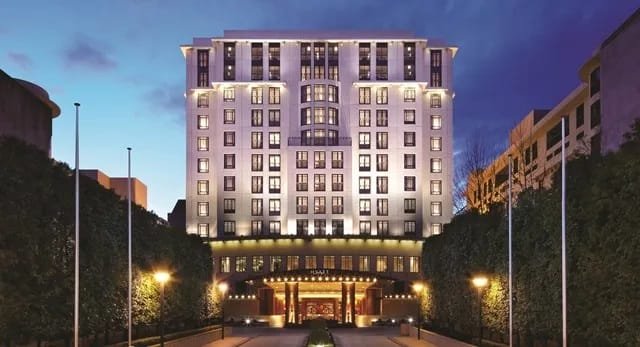

Image Credit: Park Hyatt Melbourne

Major Thai Hotel Acquisitions in FY2025

M3 Property’s latest research, Foreign Investment in the Australian Property Market for FY25, reveals a clear pattern of concentrated hotel investment by Thai groups. Major purchases include the Park Hyatt Melbourne acquired by KS Hotels for AUD 205 million, Hilton Adelaide purchased by Amora Hotels & Resorts for AUD 110 million, and the Vibe Hotel Gold Coast secured by KS Hotels for AUD 61 million. Analysts believe these transactions signal a rising appetite for tourism-linked assets and open new opportunities for developers and operators aiming to reposition or upgrade existing properties in top-tier markets.

Foreign Investment Trends Show Selective Shifts

Overall foreign investment into Australian real estate softened slightly in FY2025, dipping to AUD 8.632 billion compared to the previous year’s AUD 10.52 billion. Despite the slowdown, investor confidence remains firm as Australia benefits from an improving domestic environment, including three cash-rate cuts in 2025 that have encouraged sentiment across commercial sectors. Yet global macroeconomic uncertainty continues to shape cross-border strategies and push investors toward selective acquisitions rather than broad expansion.

The United States led foreign inflows with AUD 3.756 billion, reflecting increasing activity year-on-year. Canada’s investment surged from AUD 671 million to AUD 1.88 billion, while Japan and Singapore reduced their exposure. China, including Hong Kong SAR, contributed AUD 1.047 billion, making it the third-largest foreign investor with Hong Kong driving the bulk of that capital. A modest uptick from Mainland China shows cautious re-engagement as the region adjusts to shifting global conditions.

Investor Priorities Shift Toward Stability and Long-Term Value

M3 Property notes that tax policies played a role in the minor downturn in overall foreign capital. Even so, stabilising economic signals and strong tourism fundamentals continue to make Australia an attractive long-term play for Thai hotel groups. Their sharpened focus on premium hospitality assets underscores confidence in future travel demand and signifies a broader regional shift toward resilient, experience-driven investments that can weather global uncertainty.

Thai investors are expected to remain active bidders for strategic hotels, and their growing presence may influence pricing, redevelopment activity, and competitive dynamics in key Australian destinations. Their sustained commitment suggests that the Thai hospitality sector views Australia not only as a stable market but also as a gateway for building global hotel portfolios with lasting value.

For the latest about hotel acquisition around the world, keep on logging to Thailand Hotel News.